From flagship department stores to local independents, the UK’s retail sector is seeing continued closures.

What’s happening to UK retail?

In recent years, shoppers across the UK have noticed a steady rise in the number of empty shop units on their high streets. In 2024 alone, 34 retail businesses failed, leading to the closure of 7,537 stores and impacting 55,914 employees, according to the Centre for Retail Research.

High streets in particular have borne the brunt of these closures. But what’s driving this, and what might it mean for the future of town centres?

Why are shops closing?

- Rising costs

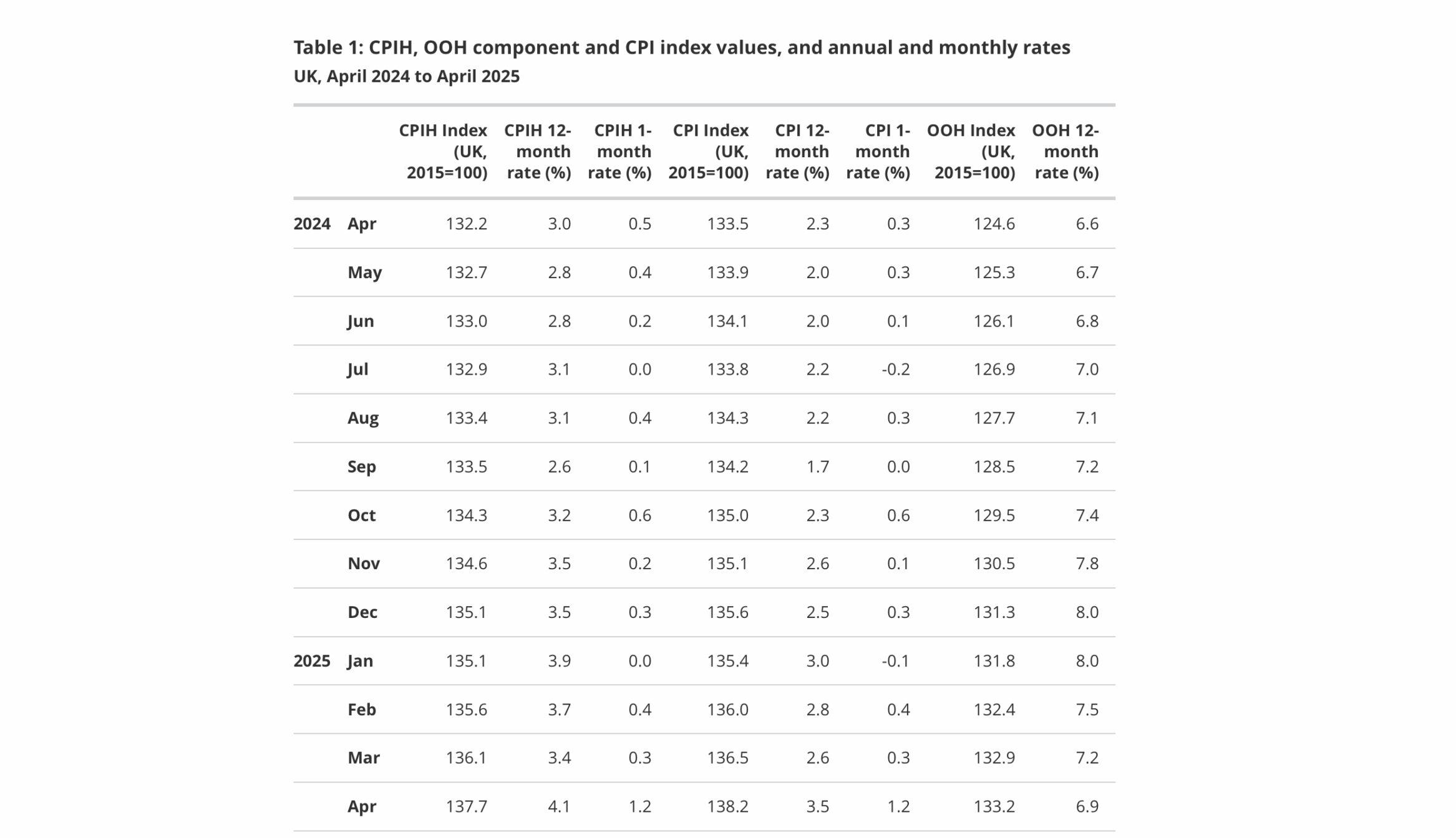

Businesses are facing increased pressure from rent, business rates, and energy bills. According to the ONS Consumer Prices Index, inflation rose by 1.2% in April 2025, following a smaller increase of 0.3% the year before. While this might sound small, compounding increases over several years have created a storm of unaffordable overheads for retailers.

Grace Polter, a retail expert and consultant, explains: “Even modest monthly increases in inflation, such as the 1.2% rise recorded in April 2025, can have compounding effects over time – particularly for sectors like retail, where margins are already tight.”

When inflation outpaces income growth and operational costs continue to rise, “the viability of many businesses, especially independents, becomes increasingly strained,” she continues. “Sustained inflation erodes consumer purchasing power and increases fixed costs, creating a dual pressure point for retailers navigating an already fragile economic landscape.”

- Legislative pressure: The Employment Rights Bill

Since January 2025, the government has begun the process of reforming the Employment Rights Bill, aiming to simplify and modernise workplace regulations. However, the Chartered Institute of Personnel and Development (CIPD) warns that, in its current form, the bill could add to the financial strain on already struggling businesses.

Based on analysis from the CIPD’s Labour Market Outlook – Winter 2024/25 survey, almost eight out of 10 employers believe the measures proposed are expected to raise overall workforce costs and put additional pressure on struggling retailers. A new statutory probation period, new rights for zero-hours workers, and changes to Statutory Sick Pay (SSP) are all expected to ultimately accelerate store closures.

“While Government has been listening to the concerns of businesses, the latest amendments show that they have much further to go if they wish to reach a place which protects employees while supporting investment in jobs. We welcome the changes made around collective consultation, but further amendments are urgently needed, particularly in relation to guaranteed hours and trade unions,” Helen Dickinson, Chief Executive at the British Retail Consortium said in response to the proposed amendments to the Employment Rights Bill.

“The focus of the Employment Rights Bill should be on unscrupulous employers who undermine confidence in the labour market, instead the current regulations risk punishing responsible businesses who provide employment. We will continue to work closely with Government on the future of the Bill to ensure a progressive approach that avoids raising the costs of employment for those already doing things well and limiting the flexibility for staff, which is so important in retail.”

- Online shopping

E-commerce giants like Amazon have reshaped consumer expectations, offering fast, cheap delivery and a wider range of products. In contrast, brick-and-mortar shops must absorb the physical costs of running a premises – and often can’t compete on price.

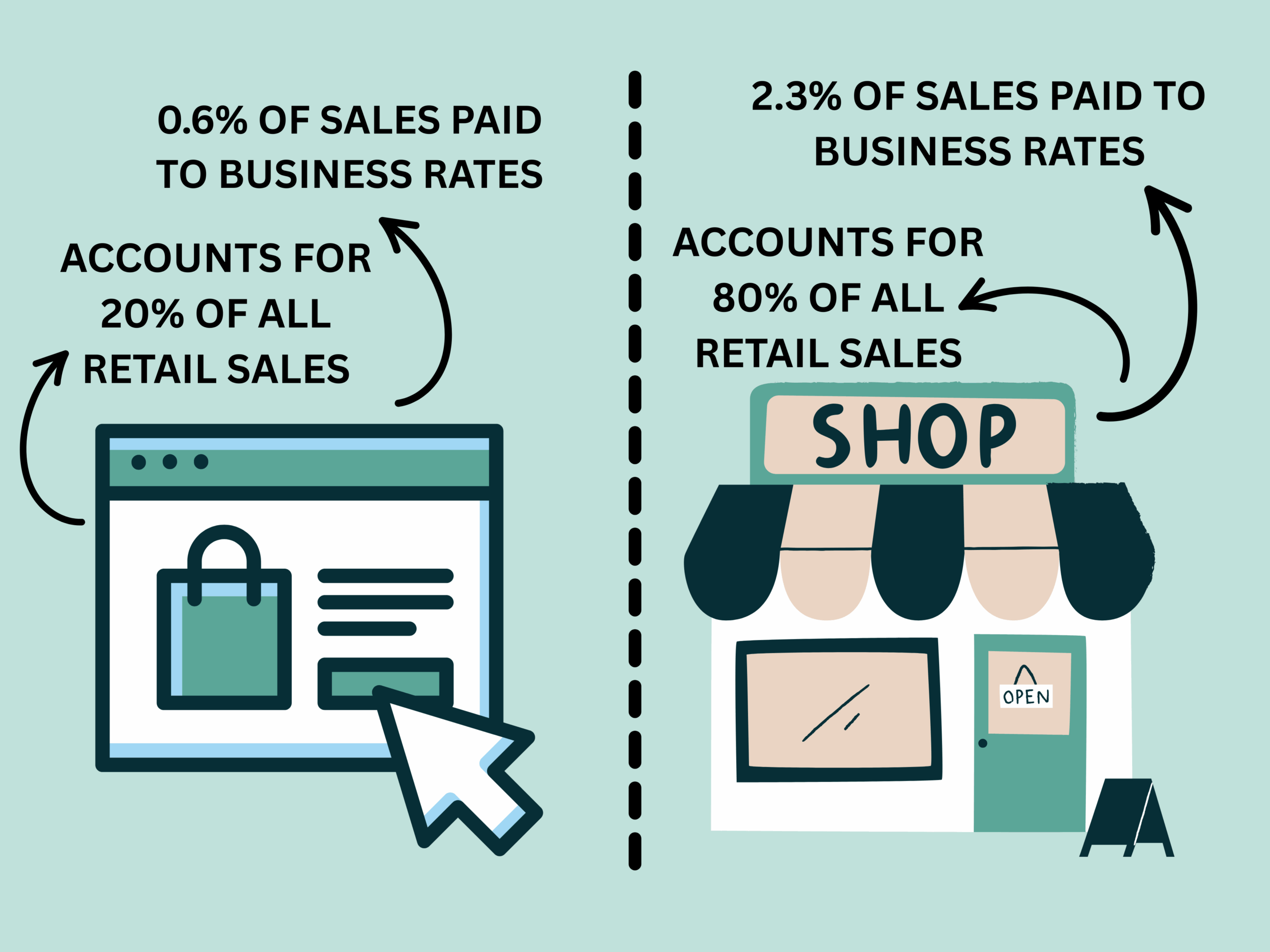

Adding to the strain is the disproportionate burden of business rates. According to the Centre for Retail Research, although brick-and-mortar retailers now account for just 80% of total retail sales, they shoulder 94% of all business rates. From 2018 to 2019, high street stores paid £7.17 billion, or around 2.3% of their sales, while online retailers contributed just £457 million – only 0.6% of their sales. This imbalance leaves traditional shops at a structural disadvantage, amplifying the financial pressures they already face.

As a result, many are finding it difficult to remain afloat – especially in high-rent town centres. As of March 2025, 26.3% of all retail sales take place online. That’s a significant jump from the 16.3% average recorded between 2008 and 2024, highlighting a long-term trend that has only been accelerated by post-pandemic consumer habits and ongoing inflationary pressures.

For many independent retailers, this digital shift not only cuts into profits but raises existential questions about their place in a market increasingly dominated by online convenience.

Are any solutions being proposed?

In response to the crisis, the government has extended its Retail, Hospitality and Leisure Relief scheme, which offers up to 40% off business rates bills for eligible properties in England for the 2025 to 2026 billing year – capped at £110,000 per business.

This measure has been welcomed by many small businesses, though Polter argues that “it doesn’t go far enough to address the structural imbalances between online and [physical] retail”.

In addition, larger retailers often exceed the rateable value thresholds, meaning the businesses most vulnerable to closure may not receive meaningful support.

What comes next?

Unless more substantial interventions are made, retail experts warn that closures will continue. Polter says the outlook remains uncertain: “Without targeted, long-term support – particularly around rates reform and workforce flexibility – we risk seeing entire town centres hollowed out.”

For many towns, the high street is both a commercial hub and a cultural identity. What replaces shuttered stores – or whether they are replaced at all – will shape the character of our town centres for years to come.