The North/South Council Tax Divide Explained

North East boroughs have the highest rates of council tax in the country – with Band D council tax increasing by an average of £116. According to research by the Chartered Institute of Public Finance and Accountancy (CIPFA), the North East is paying £444 more in council tax than households in Greater London. To visualise this, 10 Downing Street currently pays less in council tax than the average household in Stockton. So why has this happened?

What is council tax and why has it been raised?

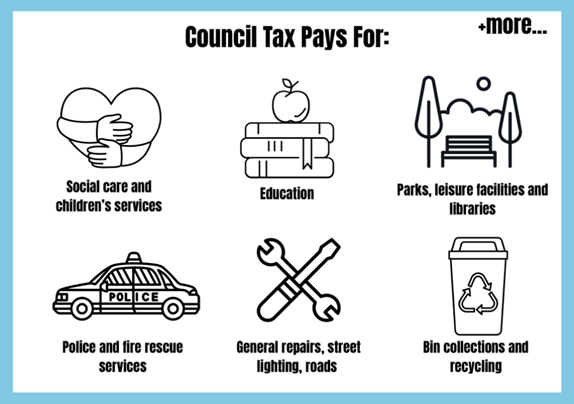

Council tax is a compulsory annual fee on properties in Great Britain that is paid monthly to fund local council services – with some exemptions.

Each financial year, core council services can be raised by up to 2.99% and the Adult Social Care Precept allows councils who are responsible for social care to raise council tax up to an extra 2% to fund such services. In Stockton, this means council tax was raised by 4.95% in April, with many northern councils following suit.

Typically, if councils opt to raise the tax above 4.99%, they need a referendum. However, six exceptions, without a vote, have occurred this fiscal year due to financial distress.

Councillor Tony Riordan, the Conservative Group Leader said: “In Stockton we have approximately 10,000 households who either do not pay any council tax, or pay a reduced amount, because of their circumstances. This amounts to approximately £18 million a year that must be picked up by those who pay the full amount.”

In Stockton, Councillor Lisa Evans, Deputy Leader of the Council, said “There’s a particular focus on children’s services where we are looking at ways to bring children in our care back into the Borough instead of paying for expensive placements.”

Austerity cuts from 2010 onward reduced funding for local councils, leading them to either cut services or borrow money to cope – especially in light of recent inflation.

Stockton Council’s Medium Term Financial Plan report to cabinet said, “we do not budget for inflation other than by exception, therefore in most instances services are asked to manage increased costs within existing budgets.”

What are the council tax bands and how do they work?

Council tax bands categorise each property by value – the higher the value, the more you pay towards council tax.

See the 2025/26 council tax band breakdown for Stockton.

Why is there a disparity in council tax for the North and South?

Council Tax Bands are based on 1991 property values and do not take into account the significant price increases of properties in the South since. As a result, the system is argued to be outdated and unreflective of current property value. People in high-value areas are paying a far less proportionate share of council tax than lower-valued households.

The North East has a majority of less valuable properties, meaning that councils struggle to raise income needed to deliver services. Essentially, it has become a regressive tax system where areas and people with less money are paying more to fund their local services.

What is the state of Stockton Borough Council?

Stockton Council, alongside many North East councils, have been victim to extreme financial pressures and within the council itself, there is much debate among councillors on whether the tax rise was necessary – with the vote coming to a weak majority of 28-24.

The Labour Council has said their transformation programme has put them in a “strong position.”

Yet, Conservative Councillor Tony Riordan said: “Borrowing is projected to increase to over £200 million in the next couple of years. The council are borrowing more but paying less of the debt off each year. An unsustainable cycle.”

Even though Council Tax is expected to rise yearly, many Stockton citizens share discontent, raising the question: is the system itself to blame?

Does the Council Tax System need reform?

There is strong debate over reform; Councillor Tony Riordan said that if councils “spend wisely, do not borrow excessively, invest properly, attract businesses” the system could work.

But, Johnathon Brash, Labour MP for Hartlepool, led a debate on March 19th demanding reform of a system that unfairly punishes poorer towns.

Some have suggested a more proportionate system, such as the land value tax. Financial adviser, Peter Graham, said: “I can understand arguments for re-evaluation of the system. Personally, I think land value tax could work instead of the current band system, because property value fluctuates too often. Yet, I’m not sure how realistic and cost-effective this could be.”

Based on Northern Powerhouse Partnership’s analysis of the salary gap between the North and South, it shows the council tax burden is 30% greater in the North. As this regional inequality deepens, will the council tax system change and is change wanted?

(Image credit: Pixabay, Steve Buissinne)