As Reading FC approaches a May 5th deadline to complete a sale or face potential expulsion from the English Football League, their situation highlights broader economic issues affecting clubs throughout the English football pyramid.

THE PREMIER LEAGUE REVOLUTION: UNINTENDED CONSEQUENCES

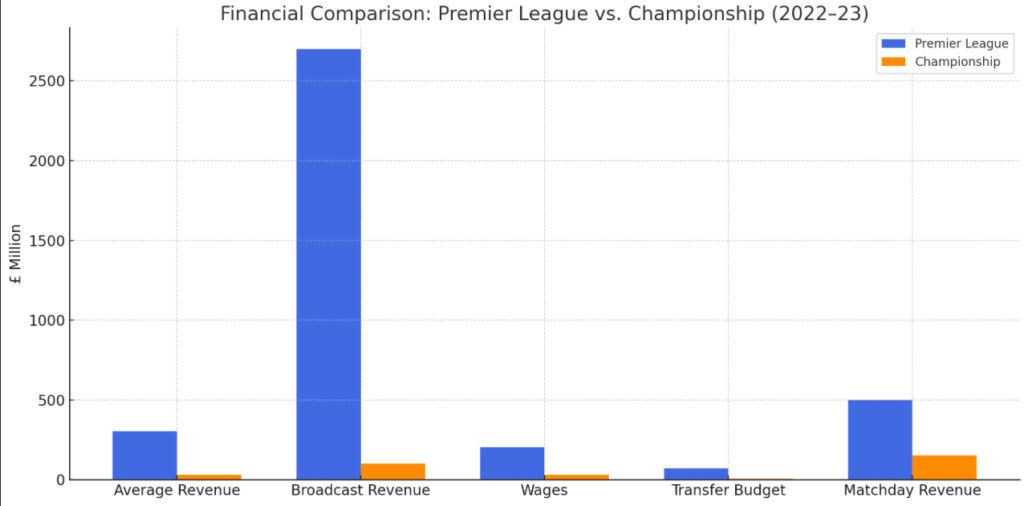

The formation of the Premier League in 1992 significantly changed football’s financial landscape. Designed to enhance the commercial potential of England’s top clubs, it has been remarkably successful – with current broadcasting rights exceeding £10 billion in a three-year cycle. This success has created a substantial financial gap between the Premier League and the rest of English football.

This financial disparity has not only separated the Premier League from the EFL but has established what Adam Williams, football finance expert, describes as economic tiers within divisions.

“You’re seeing leagues within leagues now,” Williams explains. “In the top flight there’s a big three clubs who’ve got a global pull in terms of massive international fan bases.” These financial inequalities make competitive balance increasingly difficult to achieve, with resources often influencing results regardless of management quality.

THE CHAMPIONSHIP TRAP: THE 107% PROBLEM

Nowhere is football’s economic dysfunction more evident than in the Championship. Clubs routinely spend beyond their means pursuing the financial promised land of Premier League promotion.

Mark Thompson, former Burnley CEO, provides context for this approach: “Championship clubs spend 107% of turnover on player wages.” This spending pattern continues because clubs face a difficult choice – invest heavily to seek promotion or maintain financial stability but potentially accept limited competitive prospects. According to football finance expert Kieran Maguire, “The costs of running a club in the EFL are incomprehensible from a business perspective.”

When owners prioritize financial sustainability, they often encounter resistance from supporters. “The problem that all owners have,” Thompson explains, “is that if you really cut the budget right back, your fans absolutely hate you. You get awful grief from them because they understand your chances of promotion have gone.”

This creates a system where most participants face financial challenges. With only three clubs achieving promotion annually, the remaining Championship clubs often experience financial losses despite significant investment.

THE PARACHUTE PAYMENT PARADOX

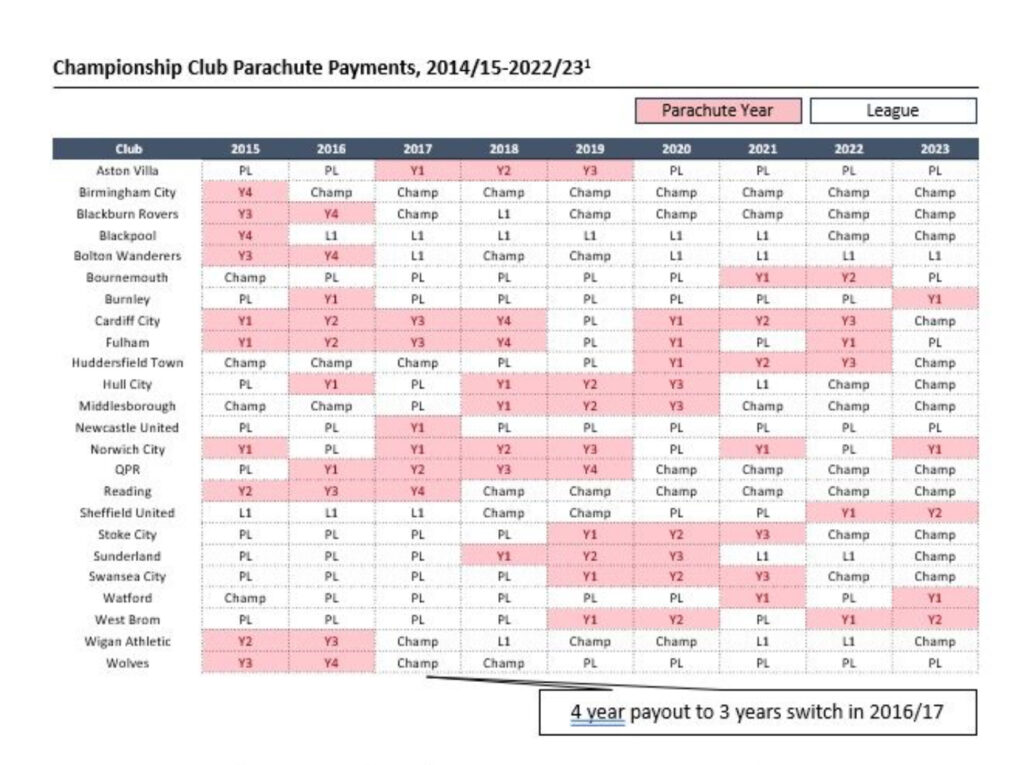

The financial disparities are influenced by the parachute payment system. Originally designed to help relegated clubs adjust to lower revenues outside the Premier League, these payments (approximately £90 million over three years) have essentially created a subset of financially advantaged clubs.

According to financial analysis by Deloitte, parachute payments to just five clubs contributed around 27% of Championship clubs’ total revenue in the 2022/23 season. This has created what Thompson describes as “a middle class of clubs” with additional financial resources.

The system contributes to a pattern where recently relegated clubs have greater resources than many competitors, leading to what Williams refers to as “yo-yo clubs” becoming “more entrenched and more pronounced.”

The statistics tell the story: approximately 60% of Championship promotion spots have been claimed by clubs receiving parachute payments in recent years, despite these clubs representing only about 15% of the division.

THE SOVEREIGN WEALTH FACTOR

factor affecting football economics is the involvement of sovereign wealth funds. These entities have introduced a new dimension to football ownership, with financial capabilities that exceed those of traditional owners.

Williams identifies this as a growing concern: “I think the role of nation states is probably the most worrying thing in terms of the level of resources being anchored by the squad cost control rules. The level of influence that these state run clubs have is just off the charts really.”

This influence extends into football’s governance structures. Williams notes that state owners have strategically positioned themselves within administrative bodies: “If you look at PSG, Nasser Al Khelaifi, who controls QSI, is basically the sovereign of Qatar, is on the board at UEFA and head of the European club association.”

This arrangement influences football’s economic framework by introducing ownership with objectives that may differ from conventional business considerations.

THE FUNDAMENTAL SUSTAINABILITY CRISIS

The data suggests that football’s current economic model presents challenges for long-term sustainability. . Despite generating billions in collective revenue, the sport’s economic structure ensures most clubs operate at a loss.

Financial reports indicate that EFL Championship clubs reported combined pre-tax losses of £315 million in the 2022/23 season, with only one club recording a profit. In League One, average pre-tax losses increased to £5 million per club during the same period.

Without adjustments to revenue distribution, cost management, and community engagement, the financial issues affecting clubs like Reading may reflect broader systemic challenges rather than isolated cases. The economic foundation of English football requires attention to ensure the continued viability of institutions that have significant cultural importance for communities across the country.

Leave a Reply